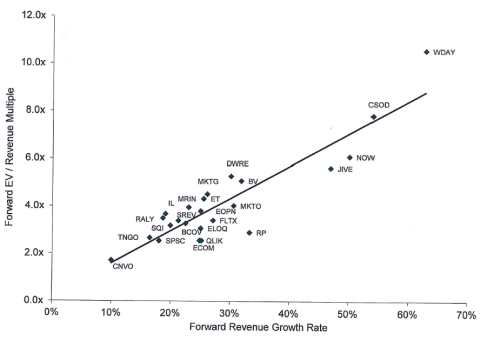

If you’ve ever wondered what drives the valuation of a SaaS vendor, then take a look at this chart that a banker showed me the other day.

The answer, pretty clearly, is revenue growth. The correlation is stunning. Taking some points off the line:

The answer, pretty clearly, is revenue growth. The correlation is stunning. Taking some points off the line:

- 10% growth gets you an on-premises-like valuation of 2x (forward) revenues

- 20% growth gets you 3x

- 30% growth gets you 4x

- 50% growth gets you nearly 6x

Basically (growth rate % / 10) + 1 = forward revenue multiple.

You might think that profitability played some role in the valuation equation, but if you did, you’re wrong. Let’s demonstrate this by looking at CY13 EBITDA margins as reported by the same banker:

- Marketo (MKTO) -44% with a ~4x revenue multiple

- Marin Software (MRIN) -40% with a ~4x revenue multiple

- Workday (WDAY) -22% with a ~11x revenue multiple

- Bazaarvoice (BV) -6% with a ~5x revenue multiple

- Cornerstone on Demand (CSOD) 0% with a ~8x revenue multiple

- Qlik Technologies (QLIK) 13% with a ~3x revenue multiple

- Tangoe (TNGO) 17% with a ~3x revenue multiple

As you can see, there’s basically no reward for profitability. In real estate what matters is location, location, location. In SaaS, it’s growth, growth, and growth.

Hi Dave,

Great post. Looks like SFDC’s acquisition of ET is fairly valued by this graph. Ie 40% growth is 6x rev and their FY13 rev forecast was for $380M

Chet

Dave

Good stuff. Hope that all is well

Carl T

Pingback: SaaS companies face revenue recognition challenges with QuickBooks

Pingback: Renew as you grow | RenewSmart

Pingback: SaaS Metrics | Alec Newcomb's Blog

Pingback: New Zealand SaaS valuations – something in the water? | Memia

Pingback: So farewell, then, 2013… | Memia

Pingback: 10 things worth learning in 2014 if you're a tech person

Pingback: Your Pricing Sucks! 6 Things to Do About It « Enterprising Thoughts | Blog of Ken Chestnut

Quick question here, is this X% growth month over month?

Growth is YoY

What multiples/metrics do Venture Capitalists look for while investing in a SaaS company? How is the valuation done while they are looking to exit from a SaaS company?

Would you happen to have an updated version of this? It would be interesting to see how much multiples have contracted now

I don’t have one handy, but I’ll keep an eye out. My gut is it’s still linear but the slop of the line has changed.

Pingback: One More Time: What Drives SaaS Company Valuation? Growth!! | Kellblog

Pingback: One More Time: What Drives SaaS Company Valuation? Growth!! - Enterprise Irregulars

Pingback: Revenue Multiple Demystified: Tech Valuations 101

Pingback: Revenue Multiple Demystified. Understand what it implies – Hacker Planet

Pingback: The Value of Revenue Growth | Mike Rogers

Is this analysis saved for mature SaaS companies? If not, that would infer the valuation of a startup growing 300% in its 2nd year is worth 31X’s their 3rd year’s revenue forecast–which seems very rich.

Pingback: How Milestones Affect Your Valuation | Mike Rogers

Pingback: Alarm.com: Saturation Of Equity For An Unsaturated Market | Growth Investing Research

Pingback: How companies value startups before acquisition | CorpDev.io